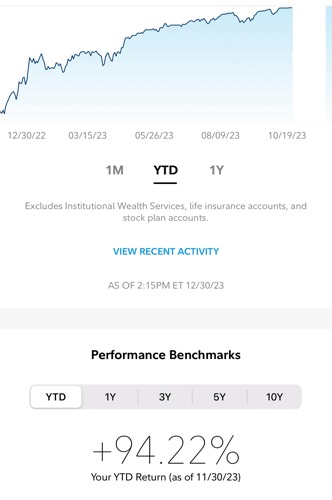

How To Invest To Get 26% At Retirement

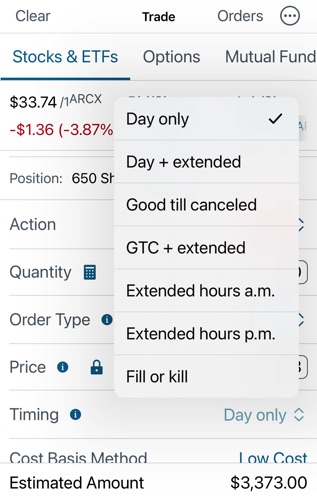

Since I decided to retire, no more work because there’s no job could pay me $340k+/year as my investment would provide. This is how I invest my money. BTW, this is how I’ve been doing and not to recommend anyone, just for information only. The stock market is extremely volatile, at retirement age, I don’t …