This year the market was in bear market and many stocks pay dividend with high forward yields because the stock prices are low. This is a good opportunity for me to invest in these beaten down stocks with high dividend. When the market is back to bull, we expect the stock prices will be higher then the yields will be lower. Regardless if how the prices are doing, I still got in with a high dividend, making money while waiting to rebound.

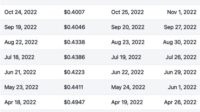

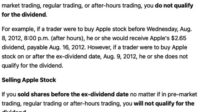

ex-dividend: This date is the date the company will pay for the shares I have at the open which means I have to have the stocks the day before. Even if I sell the stock on this day, I will still receive the dividend on the pay date. But most of the time, the price on the ex-dividend is lowered by the same amount of the dividend.

These are the stocks that would be good candidates for dividend and growth: INTC, STX,VZ, MO, T

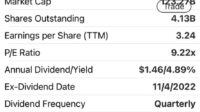

- INTC: This stock has been beaten down by AMD due to Server CPU, but it pays $.365/share = 4.89%/year forward dividend and it’s coming out with a new Server CPU that would get back the market share with the current price of $29.

- STX: This stock also has been beaten down due to slow computer sales and dollar strength globally. The 52 week high was $117, with the current price $54, it pays $.70/share = 5.19%/year forward dividend.

- VZ: Verizon Wireless is also down due to fierce competition as T and T-Mobile. They’re aggressively came out with plans that attract customers like me, $25/month and high speed 5G internet for $50/month. I’ve moved from T-Mobile to Verizon this year. It pays $.6525/share with 6.77%/year forward dividend with the current price of $38.

- MO: Altria is a dividend stock that pays well although the stock doesn’t move that much. It pays $.94/share with 8.51%/year forward at the current price of $44.

- T: ATT Wireless. The stock has been stabilized since they sold off the Enterntainment business. At the current price of $19, paying $.2775/share with 5.85%/year forward dividend.

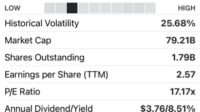

- XYLD: SP500 ETF covered call, for people who just want high dividend, this stock pays handsomely and consistently for many years. At the current price of $40, it pays $.4/monthly with 12.1% forward which is great for just dividend income.

Buy/Sell ex-dividend date?