Many people work and put money in 401k or IRA or ROTH IRA don’t know what to do with the money saved in there. If you have money in 401k from work, if you don’t manage yourself, they will put in automatically funds that benefit or high management fees for the 401k managers.

- 401k: we should choose what funds have the greatest return. We put our money in 3 index funds: SP500, Nasdaq, Semiconductor. Depends on your 401k, they may not have the index funds that we want, but all must have SP500 funds in some form or another. If there are not many funds, just put all in SP500. In 401k we can’t buy or sell in real time, like Fidelity FXAIX is the SP500. Every time we sell to put into cash (money market), we put the order and wait until the end of the day for them to execute. Why would we want to exchange index funds to cash (money market – currently 4.5% interest)? When the market is going down like 2021 and 2022, we could get out of the SP500 to money market, and when the market’s going back up, we can exchange back into the index fund, the same as sell high and buy low.

- IRA: this is traditional IRA, when we’re over 59.5 year of age we can rollover from current 401k to IRA so we can buy and sell stocks freely as a normal brokerage account. The only draw back is we can’t borrow the money from IRA but we can borrow against our 401k. Many people who worked and left the company, but still keep the old 401k, this is not a good thing. We need to rollover OLD 401k to IRA so we can invest freely. For people who don’t have 401k, self-employed, you can contribute to IRA for your retirement also, but check with the accountant to see how much you can contribute for tax purposes.

- ROTH IRA: This is after taxed IRA, which means the money you put in ROTH IRA already Taxed, every year, IRS allows you to put a certain amount into this IRA, check with IRS. The benefit of this IRA is when we retired, whatever we have in there can be taken out without paying taxes on the capital gain, unlike IRA or 401k. With ROTH IRA we can take out the principle any time because it’s our after tax money.

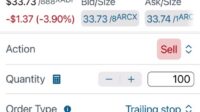

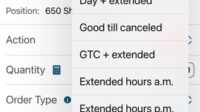

- Brokerage:When we open an IRA or ROTH IRA account, make sure the brokerage allow us to buy and sell stocks with many options, stoplimit, stoploss, trailingstoploss, buy-sell after hours and pre-market so we can take the advantage of the option when we trade. IRA and ROTH IRA accounts, we can buy and sell without the worry of being WashSale.

- Brokerage account for cash trading: This is the account we put our savings to invest to make money. Make sure to have brokerage that have all the trading options mentioned above.

- Trailingstoploss Schwab with points

- Fidelity after hour option

- Schwab after hour trading option

Disclaimer: Everything I said here is my experience only, and I’m not a professional financial advisor, please do your own research to get the correct information you need.