Since I decided to retire, no more work because there’s no job could pay me $340k+/year as my investment would provide. This is how I invest my money. BTW, this is how I’ve been doing and not to recommend anyone, just for information only.

The stock market is extremely volatile, at retirement age, I don’t want to put all my money at work because if the market goes stagnate for 10 years like in the 70’s, average 1.6%/year unlike now about 17%.

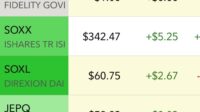

I only invest in Semiconductor ETF, SOXX and SOXL, SPAXX, FRGXX, SPYI, JEPQ since I’m home and monitor the stock market daily.

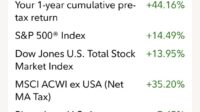

1. The goal is only invest 1/5 = 20% of total money in the ETF, 1/5 in SPYI, JEPQ for dividend 10%+ a year. The rest is in cash to get 3.4% from Fidelity Money Market ETF SPAXX and FRGXX.

2. SOXX is Semiconductor ETF and SOXL is leveraged 3x of SOXX, which is great when the market goes up, but extremely bad when the market goes down because it’s 3 times the gain and 3 times the loss. I’ve been doing this for 3 years now and I know how to trade SOXL.

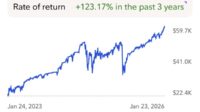

3. SOXL has been having average of 70 gapdowns and 70 gapups per year, based on the notion that all gaps must be filled, if I’m disciplined and patient, my 1/5 of money could gain 100% = 20% of total money I have and the rest can come from dividends. Buy gapdowns and sell gapups. Follow the chart to the T. Recognize pattern up 10 down 5 or down 10 up 5 and buy and sell accordingly regardless of market down or up.

4. SP500 always the sure thing, but when I need money consistently, nothing is sure. Since I’m still sound with minds and body, my goal is 100% every 3 years which means 26%/year compounded.

Cheers,